Table of Contents

LOGISTICS IN VIETNAM

The rise of new transport and supply chain trends in the digital economy has helped Vietnam become a potential emerging logistics market.

Potential emerging logistics market

Located in the heart of the Asia-Pacific region, on the international maritime route; especially with a long coastline, and many locations where deep-water ports can be built, opportunities for international economic integration are getting deeper and deeper with many free trade agreements (FTAs) signed, etc. Price is a potential market to develop the logistics service industry.

After more than 2 years of being heavily affected by the Covid-19 pandemic, entering 2022, logistics activities have gradually returned to normal, gradually ensuring connectivity in transportation and goods circulation. Not only in economic centers and satellite localities, many provinces and cities across the country have also paid more attention to innovating logistics activities, developing services, and infrastructure, and connecting logistics between the two countries supply chain actors; consider this an important factor promoting the recovery of production and circulation activities, contributing to helping Vietnam’s import and export value continue to set a record when our country transitions to the “new normal” phase and take advantage of the opportunities brought by the signing of FTAs.

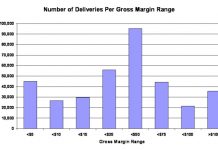

With a high growth rate of 14-16% in a year, the logistics industry has made significant contributions, making import and export activities a bright spot in Vietnam’s economic picture. In 2022, the total export and import turnover will reach more than 723 billion USD, up 10% compared to 2021. This is an encouraging result in the context of global and domestic trade facing many difficulties due to the impact of the pandemic. Covid-19 and risks, economic and political instability on a global scale.

The rise of new transport and supply chain trends in the digital economy has helped Vietnam become a potential emerging logistics market. Vietnam became one of 29 Logistics centers under the World Logistics Passport Program. However, in order to realize the aspiration to turn Vietnam into a regional logistics center, many internal “bottlenecks” need to be removed soon.

One of the first limitations restraining the development of Vietnam’s logistics comes from the lack of synchronous logistics infrastructure. For example, Cat Lai (Ho Chi Minh City) is the largest international container port in Vietnam, a key focal point in the seaport system in the Southeast region, but for many years, surrounded by congestion, has reduced the operations economy of the whole region.

On average, there are about 19,000 to 20,000 cars entering and leaving the port every day. Due to the unreasonable traffic structure, at peak hours, container trucks are often stuck here for a few hours before entering the port. , the fuel consumption will be more, and the freight time will be slowed down. Another example, currently, 90% of goods are handled and transported by waterway, while inland wharf infrastructure is still lacking.

This creates a situation: Goods manufactured in Phu My town (Ba Ria-Vung Tau) must be moved to Binh Duong for container packing, then transported from Binh Duong again – where enterprises incur additional costs for lifting – Lower to Cat Lai port for export. High logistics costs are equivalent to about 20% of GDP; meanwhile, in developed countries, the corresponding rate is only about 7-9% of GDP…

In terms of human resources, it is expected that by 2030, the demand for human resources in logistics will be more than 200,000 people; Meanwhile, the ability to meet logistics human resources is only about 10% of market demand. Vietnam’s logistics human resources are not only lacking in quantity but also weak in quality.

According to the Vietnam Logistics Report 2022, the number of well-trained workers in logistics services only accounts for about 5-7% of the number of employees working in this field. A survey by the Ho Chi Minh City Development Research Institute also showed that up to 53.3% of enterprises lack staff with professional qualifications and knowledge in logistics, and 30% of enterprises have to train. Regarding employees, only 6.7% of enterprises are satisfied with the staff’s expertise.

Not only is Vietnam limited in terms of transport infrastructure, human resources, and logistics, but it is also rated as “crowded but not strong”. As an example, Vietnam has more than 30,000 enterprises registered to operate in the field of logistics. The logistics market has the participation of more than 5,000 enterprises providing 3PL logistics services. Of which, 89% are domestic enterprises, 10% are joint venture enterprises, and 1% are 100% foreign-owned enterprises providing transnational logistics services, with big names such as DHL, Kuehne + Nagel, DSV, DB Schenker,…

Although domestic enterprises account for a large proportion, they only account for about 30% of the market share, the rest belongs to foreign enterprises because Vietnamese enterprises are mainly small enterprises, limited in both capital and size. human resources as well as international operation experience, there is no link between stages in the logistics supply chain and between logistics service enterprises and import-export enterprises. Therefore, on both the buying side and the selling side, domestic logistics enterprises are limited in terms of “playing ground”…

It can be said that if the economy is the engine, then logistics is likened to the lubricating oil for that machine to operate smoothly, and achieve the maximum capacity with the least fuel cost and the highest durability. Therefore, giving urgent solutions to be implemented to overcome the inadequacies and weaknesses mentioned above, supporting logistics service businesses to develop on the basis of cooperation and healthy competition, and creating a link between logistics service enterprises and manufacturing and trading enterprises is an urgent requirement.

VIETSHIP PROVIDES LOGISTICS SERVICE

More: