Table of Contents

THE RELATIONSHIP BETWEEN AMERICA-CHINA

The rift in US-China relations has caused Western companies to leave the Asian powerhouse, but the process cannot happen quickly.

Introduce

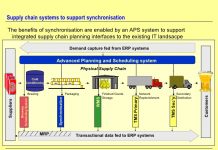

A supply chain analysis by Trade Data Services (TDS) shows that the US and Europe are making moves to shift logistics as well as supply chains.

“There are customers who don’t want to ‘put all their eggs in one basket’ in China. So they are looking for other solutions but not to a great extent yet. It will take time. Maybe in 5 or 10. next year, if India and Southeast Asia build ports that can accommodate large ships, they will play a bigger role,” CMA CGM CEO Rodolphe Saade told the Financial Times.

America, EU, Vietnam and China

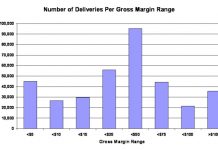

Data from TDS shows that American and European companies have been increasing trade cooperation with Vietnam in recent years. Vietnamese goods exported to the US increased from 10% to 16% in the period 2018 – 2021.

However, African, Asian or South American countries do not have much logistics volatility for the European market. They are increasingly dependent on China, with more than 30% of their imports coming from the country of billions of people.

“China is an importer of goods for many economies around the world. However, as a rule, the US and Europe are less dependent,” the TDS report noted.

Supply chain fragmentation

Several economists have discussed supply chain fragmentation. The world is being reshaped into two competitive trading blocs led by China and the West, said Mr. Coleman Nee (WTO).

Although Southeast Asian countries are benefiting from supply chain shifts, caution is still needed. While US demand increased, demand from Europe remained flat, at 3%.

Moreover, the US increased imports from Mexico from $293.5 billion in 2016 to more than $384 billion in 2021.

Some American companies are also investing in warehousing facilities in their southern neighbor.

The WEST began to separate trade from China

“Demand in Mexico is at an all-time high and is likely to continue,” Chris Caton, Prologis head of global strategy and analysis, told The Wall Street Journal.

As the West began to separate trade from China, companies describe it as a changed business model, marking the end of globalization.

“I don’t see the end of globalization, but the next two years don’t look like a good time for long-haul freight,” said Nick Coverdale, a Hong Kong-based delivery company.