Table of Contents

What is HS Code?

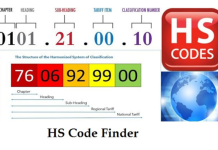

HS (Harmonized System) Code is a standardized classification code for goods used to classify products in import and export. It is used by customs authorities worldwide to identify products for taxation and statistical data collection.

The HS Code is managed by the World Customs Organization (WCO) and is updated every five years. And it serves as the foundation for the import-export classification system used in the United States and many trading partners.

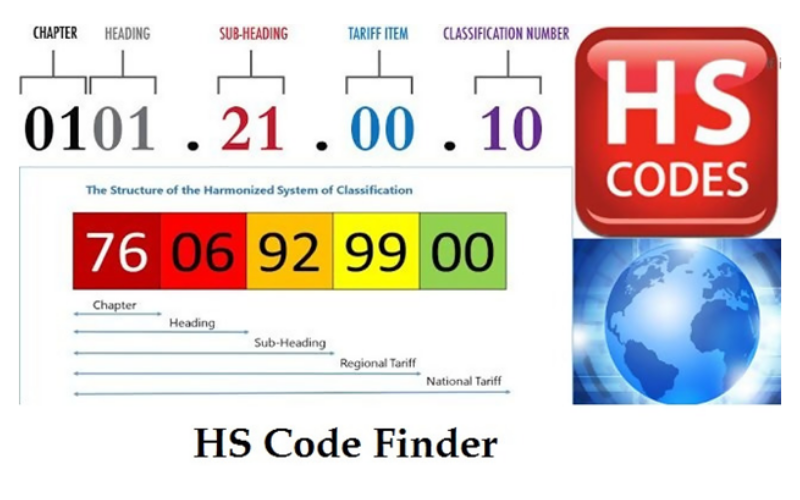

Structure of HS Code

The HS Code specifies specific six-digit codes for different classifications and goods. Countries are allowed to add longer codes to the first six digits for further classification.

The structure of the HS Code includes different parts that are divided from the broadest to the most specific.

The largest part is the Section, which contains Chapters. Within the Chapters, there are Headings, followed by Subheadings and finally Subheadings of subgroups.

There are 21 or 22 different Sections. Each section has its own separate explanatory notes for users. There are 97 Chapters, with Chapters 98 and 99 specifically designated for particular countries. Each chapter has its own separate explanatory notes, and the first two characters provide a general description of the type of goods.

The Group consists of 2 characters and represents broader groups. The Subgroup further divides the groups, also consisting of 2 characters. The Subheading of subgroups uses 2 characters to indicate country-specific regulations.

Currently, Vietnam applies an 8-digit HS code for goods, while some countries around the world may use a 10- or 12-digit HS code.

Simple and accurate ways to look up HS Codes

- Based on existing documents: Existing documents will have the HS Code of your company’s goods. Based on that, you can determine the code for upcoming imports and exports of similar goods. This method applies to the same type of goods that have been in operation before.

- Consultation with experts: There are many consulting and documentation services available. You can consider choosing these services. They are experienced and have close contacts with customs officials, making them knowledgeable about the accurate code for customs declarations.

- Use HS Code lookup websites: You can search on official websites such as Customs.gov.vn, the website of Vietnam Customs. Here, you simply enter keywords related to the goods in the search bar, and there will be many results. Click on the most accurate information, and further subgroups with codes will be displayed for your selection.

- Based on tariff schedules: Goods are subject to specific import and export tariffs. Based on this information, you can find the HS Code more easily. However, this method requires using Excel and the search command for quick results. Press Ctrl + F and enter the keyword to search.